Using global and domestic SEC-reported data, I have previously published articles tracking and evaluating the "growth" and "saturation" status of the commercial sector known as "multi-level marketing", MLM.

Recently released data from Herbalife (NYSE:

HLF) most clearly illustrate the new reality of the end of the MLM "growth" era, and this nothing to do with the recent controversies of fraud charges against Herbalife.

The MLM sector includes global companies, Herbalife (

HLF), Nu Skin (NYSE:

NUS), Usana (NYSE:

USNA) and Avon (NYSE:

AVP), among about 10 others on Wall Street. Its largest private representative is Amway, the progenitor of all current MLMs. Avon predates Amway as a company but adopted the Amway-model only after 2000, and only partially. There are now perhaps over 1,000 MLMs in the USA!

Wall Street Acceptance of MLM, Pyramid Scheme or Not

After years of confusion on Wall Street, it is now widely accepted that "MLM" is a distinct sector, though its definition and legal status are still contested. It is widely understood that, whatever MLM is, the common denominator of the sector is a shared commodity of human recruits who operate under essentially identical legal contracts, unique to MLM and who serve as the direct and ultimate source of almost all revenue. This common revenue source is gained by inducing the recruits to seek financial rewards tied to the hallmark MLM "business opportunity." This shared and virtually identical "business opportunity" offered by all MLMs always depends upon recruits recruiting other new recruits in a classic "endless chain" proposition.

In putting all MLMs together under one sector, it is implicitly understood that the various consumer products offered for sale and their unadvertised brands do not characterize or define individual MLMs. The various products (usually pills, potions and lotions) are merely incidental elements of the shared recruiting and money transfer mechanism. As to the legitimacy of MLM'sdefining pay-to-play, contractor-recruiting-contractor, endless-chain model, Wall Street generally embraces it but presumably only as long it continues to "grow."

For a full economic and philosophical endorsement of the MLM business model see the booklet by a Dr. Lasdwun Luzes who boldly lays out the case,

In Defense of the Pyramid Scheme.

The Party is Over

I will publish a comprehensive summary of 5 years of data of publicly traded MLMs, from year-end 2010 with analysis of the demographic and information saturation factors when SEC reports are available. However, 2015 data already reported by several of the largest MLMs support my earlier analysis that the heyday of MLM is finished, never to return. There will never be another MLM ballooning to the size that some of today's MLMs reached a few years ago. This 35-year MLM pandemic occurred while the FTC deliberately ignored it or administratively dithered over arcane definitions of "pyramid scheme" and some FTC officials strolled through the lucrative revolving door between the FTC and the MLM "industry."

Free from law enforcement, MLM's recruiting rampage carried this American racket to every corner of the globe, with China as the last stop. Now, in the face of global saturation, based on growing public awareness and demographic limits, the larger MLMs can no longer claim "momentum" and "explosive" growth to lure in recruits. The current challenge of these companies today is to manage unfolding collapse while still promising "unlimited income" to new recruits.

- Amway, the oldest MLM with the longest global reach, reports (unverified, since it is a private firm) its global revenue has recently dropped to its lowest point in 5 years. The decline appears to be accelerating, moving from minus 8% in 2014 to minus 12% in 2015. Much of the decline occurred, Amway claims, in China, which had accounted for the previous spike.

- Avon, the MLM with the largest number of members, suffered a 34% revenue drop since 2010 (including North America revenues in 2015) and has just sold off its entire North American operation, where the company began over a hundred years ago.MLMs classically saturate earlier markets, requiring constant expansion for "growth."

Investors who still hearken to MLM's historic and enigmatic "growth" rates, even in the middle of global recession, should take note that this recent reversal of fortune is not cyclical but inevitable and irreversible.

Growth, Quote UnQuote

"Growth," as it is conventionally understood, must be put in quotes when referencing MLM because MLMs misuse the term to confuse consumers and investors as part of an entire vocabulary of pseudo-business terms and phrases, including the meaningless term, "multi-level marketing" itself ("multi" actually means infinite).

I see firsthand how effective this linguistic flim-flam has been in sowing confusion from talking with countless MLM participants, providing professional consulting to dozens of Wall Street analysts on MLM, and being interviewed by journalists assigned to report on this or that MLM stirring up local discontent across the world. Consumers cannot discern the indecipherable MLM play plan and are not told of MLM's epic turnover rates among recruits. Without a good grasp of algebra few can untangle the misleading "income disclosures" - among the few MLMs that offer them at all - revealing 99% loss rates. Aiding and betting the concealment and NewSpeak, the FTC specifically exempted MLMs from all financial disclosure requirements as they solicit investments from millions of people each year.

Explaining the Unexplainable

Wall Street researchers, charged with due diligence on behalf of investor groups, earnestly try to apply conventional metrics to MLM in the naïve belief that MLMs compete and grow like real companies. They imagine MLMs gaining customers from competitors with similar products or creating new markets that add to an existing year-upon-year base of brand loyalists. They further imagine that new customers are won over by profitable salespeople who sell products based on market factors like pricing, quality, technology advantage or some valuable differentiation, resulting in profit to them and "growth" to the MLM enterprise.

Yet, these researchers are invariably flummoxed to explain a seemingly inexplicable factor that contradicts their "sales" thesis. This is the extraordinary attrition among adherents, reaching virtually 100% in several years. After signing contracts and paying fees, why would salespeople or even customers abandon a "growing" company with loyal buyers in such numbers and so rapidly? To reconcile the mysterious phenomenon, they bravely search for other market-based factors like variations in start-up fees.

For investor purposes, analysts do their best to exclude deception and fraud as factors. They must do this in the face of otherwise inexplicable consumer behavior, massive consumer loss rates, cult marketing techniques by MLMs and continuous churning of what they define as "salespeople" and "customers" without being able to determine exactly who is selling to whom or what the real products are.

In reality, none of these market-based factors applies or has anything to do with growth or decline in MLM. Quitting rates turn out to be the same across the board, having nothing to do rational buying, fee levels, or diligent investing. Indeed, conscious buying or investing "choice" isimpossible in MLM since no one is ever fully or adequately informed when recruited. MLMs sell anon-existent income opportunity. Therefore, conventional sales and marketing laws and definitions that govern real commerce, in which actual value is exchanged, do not apply.

Non-existent Opportunity

In describing the marketed MLM "income opportunity", I call it "non-existent" not editorially but based on a tedious analysis of the bizarre MLM pay formulas that transfer most commission dollars, per transaction, to the top of an enormous recruiting chain, and impose burdensome pay-to-play purchase requirements on new recruits, serving as the chief revenue source. My description is further supported by de-constructing the available income disclosures that reveal 99% loss rates among all MLM adherents, year in and year out, including those who pay the much higher fees to start out at higher potential pay rates.

Take the Test

Here's a test, requiring only arithmetic, that should settle all question about the existence or absence of an MLM "income opportunity." Take any of the larger MLMs and add together all the people that have ever paid money to become eligible for the fabled "income opportunity", dating from the company's inception, and then ask how many or what percentage of all of them ever did earn a profit or are gaining it now. No one does this in the media or on Wall Street, perhaps because the answer would be too shocking to accept. Hundreds of millions of people, over three decades were obviously churned through a mill of false income promise only to "fail." Even those the MLMs claim are only "discount buyers" universally disappeared. A tiny cadre of recruiters at the top profit directly from those losses, year in and year out. Yet, millions more are still successfully recruited? The specter of commercial deception on such a scale, while the FTC looks on, is literally unthinkable for some analysts and reporters, much less ordinary consumers.

Not Growth

Referring to growth, I employ the phrase, "as it is conventionally understood," because MLMs do not grow according to how that term is conventionally used in business. MLMs that "grow" are only outpacing attrition each year. There is no large base of salespeople or customers upon which to "grow." There are no loyal or repeat customers of any consequence. Only if recruiting outpaces attrition, can revenues be larger YOY. The sales force and the customers did not grow. They were replaced. Collapse occurred more slowly than recruiting accelerated, and the scheme was thus able to give an outward appearance of organic growth, unless one looks more closely. Real growth requires success and satisfaction of earlier buyers and salespeople. MLMs, however, leave almost total failure, abandonment and disappointment in their wake.

The Meaning of No-Growth in MLM

Before citing more of the available company data and their significance, it is important to consider the meaning of MLM's recently arrived at "no-growth" status from the consumer' interests, not just the investors'. A no-growth conventional company can obviously remain profitable and valuable to customers. However, in MLM, growth is not a market condition; it is a promise on which value-for-payment-received is based. It is therefore an existential requirement. But, without capacity for outpacing collapse, MLMs now have no basis at all for claiming that new recruits have a chance at success and therefore cannot plausibly pretend to offer value in exchange for payment.

Let us be clear in recognizing that individual success in all MLMs is not based on personal sales or "direct selling" as it is called. In 15 years of work in MLM, I have not found an individual who earned sustainable profit without recruiting other recruiters. No one in MLM has or does gain sustainable profit from individual door-to-door selling, an outmoded and unnecessary method of product distribution. Add in absurdly high prices, an upside-down commission plan that rewards the recruiter and oppresses the street-level retailer, unprotected territories, constant inundation of competitive salespeople, no advertising allowed, punishing inventory purchase requirements, and the MLM "direct selling" business is revealed as an utter sham.

MLM "growth" is not an added benefit but a requirement, since 50-80% of the entire sales force and customer base (for the most part, one and the same) disappear annually and the remaining market shrinks. Yet, for any significant number of new recruits to succeed, the overall chain must get larger and longer. It is this contradiction that leads to the conclusion of many experts that the business model is "inherently" unsustainable and deceptive. An MLM enterprise can thrive only on the failure of its churning and "losing" adherents.

Mimicking Growth

Up to recent times, geographic expansion and brief periods of local increases in prospects, usually brought on by economic distress, could at least mimic sustainable growth or perhaps support the claim that recruiting could alwaysoutpace attrition, giving some recruits a chance to "win" though at the expense of their recruits. But, if revenue records show local and globalcontraction, on what basis can the MLM company base even a bogus promise to the "last ones in" of viable profit opportunity based on "infinite" recruiting?

Properly understood, the new status of no-growth-due-to-saturation lays bare the realities of MLM for regulators and investors who might still be charmed by MLM's historic "growth", promises of perpetual growth or the newest predictions of return to growth.

Nu Skin: Pop and Drop

It has already been shown that MLM's greatest icons, Amway and Avon, have experienced dramatic drops in revenue recently. Nu Skin, also one of the larger and older MLMs, serves as a further illustration of the trends in maturity and reveals "growth" as merely a reflection of the "last ones in."

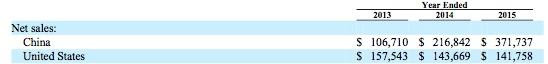

Nu Skin's China "growth" exploded almost 400% between 2012 and 2013, catapulting China to Nu Skin's largest market and accounting for 32% of total revenues. Then in just two years, revenue was nearly cut in half. Between 2013 and 2015, Nu Skin's global revenue dropped by $929.7 million. The drop in one market, China, accounted for about half of that global drop.

Usana: Chasing Nu Skin

Usana is a commercial clone of Nu Skin, both enterprises coming out of Utah, that font of MLM startups and "food supplements." In saturation status it is only a year or so behind Nu Skin before hitting the China Wall. Extreme slowdown has already been reached.

Consider the drastic change in rates reflected in language in the end of Q4 8Ks of 2014 and 2015. In 2014, Usana trumpeted net sales growth in Asia Pacific (including mainland China) of 34.1% compared to same period a year before. It also added that it achieved a 25.4% "sequential" increase over the 3rd quarter of that year. This is the classic MLM "exponential" growth achieved with mesmerizing and illusory endless chain incentives offered to virgin recruits in newly invaded territories. A year later, there is no bragging of a sequential increase. It had dropped to just over 2% and annual "growth" for the quarter was just 5.4% over the same period a year ago.

Between 2013 and 2015, Usana "grew" by $200.5 million globally, now edging close to a billion in total revenue. But during this same time frame, it "grew" in Greater China by $169.47. China, a market that Usana only recently entered, accounted for 85% of Usana's global "growth" in the 2013-2015 period. It opened in mainland China with an entirely new line of goods from a small, obscure China-based company selling "baby" products in a country that limits families to one child! Yet, with a new product, in a new land, Usana reports that Greater China is now approximately half the company's total global revenue! Breaking it down even closer, reveals thatUsana is dropping in the areas of Greater China where it entered first, like Hong Kong. Go figure.

Analysts may deduce that all the rest of the world, accounted for only 15% of Usana's "growth" in the last two years. Excluding Greater China, Usana grew just 4% in the last two years. China, the "last ones in", sustained the company and enabled it to tell hopeful recruits in all other countries that it was explosively "growing", though in many places, even its home country, the USA, it was actually in contraction. Unless you have cousins in China, the actual data showed that the chance of your building a large local downline based on friends and family, ignoring the financial consequences to them, was bleak indeed.

Usana USA "Growth" Obscured?

Analysts that question the sustainability of Usana's earlier rocket-like growth (almost entirely in China, it turns out) might want to know of Usana's performance in the USA, where it all started. Shouldn't this be the strongest area, where it is best known, faces no currency "headwind" and should have the largest base of satisfied adherents over more than 20 years of operation?

This is a question I have special interest in since "saturation" in MLMs occurs in earlier markets where demographics and actual failure rates finally take their toll. It turns out that Usana makes it difficult to know for sure USA revenue and recruiting status. Is the "drop" concealed while the "pop" is touted?

The reported data does show steady but modest declines in the USA revenue, -10%, while mainland China grew +332%, but, incredibly, Usana has confused the definition of "USA." In 2000, Usana began merging parts of Europe's data with the USA's.

From Usana's

Q-2, 2000, "

Since the beginning of the second quarter of 2000, the Company's United Kingdom market has been serviced from the United States and Is no longer an operating segment of the company. The company's operating segments are based on operating geographic regions." Usana reported in Q1 2012: "

North America - United States (including direct sales from the United States to the United Kingdom and the Netherlands), Canada, Mexico, France(1), and Belgium(1) … The Company commenced operations in France and Belgium during the last week of the first quarter of 2012. Net sales and customer count information for these two markets have been included with the United States for the quarter ended March 31, 2012."

Say what? Europe is counted with North America for net sales and customer count? And Usanais adding new countries in Europe, making "North America" an expanding market?

The seemingly modest and gradual decreases in the "USA" that Usana reported to the SEC are contradicted by Usana's income disclosure reports to consumers, not to the SEC. These disclosures are based only on the real North America, not a fictional one presented to shareholders and the SEC. In its North American

Average Total Earnings for 2011 the total of USA Associates that purchased at least one product (active) was reported as 135,590.

Then, when Usana updated this USA data disclosure with

2014 data, only for geographic North America, Usana reports only 61,400 associates qualified as active by making one purchase. That's a 54.7% domestic decline in three years. Shareholders seeking insight into Usana'sfuture, especially its future in "explosive China" may want to know exactly how Usana is doing in the 50 states of the USA, really. It is the harbinger for China.

Herbalife: China and Latinos Sustain the Illusion of "Growth"

Herbalife came into being two years after a controversial FTC decision reversed earlier rulings against MLMs and allowed Amway's pyramid plan to continue, based on its sworn testimony that it was a retail sales company, not a recruiting scheme. Herbalife cloned the Amway play plan and after 20 years of operation, Herbalife entered the China market in 2001, one of the earlierMLMs to go there.

Now, after just 14 years in China, revenue from that country is almost entirely sustaining Herbalife, offsetting saturation in most of the rest of the world, including the USA, its home market.

- Between 2013 and 2015, Herbalife declined in global revenue by $142 million. But in the same period revenue "grew" in China by $370.9 million. Excepting for increases in China, Herbalife's global revenue would have dropped over 9% in the last two years instead of -0.34%. As with Amway, Nu Skin and Usana, China is Herbalife's "last ones in," keeping afloat any claim at all for "growth."

- In the last five years, Herbalife's reported annual revenue increased by $1.7 billion. 38% of that "growth" occurred in mainland China alone and at the same time, Herbalife entered 16 other new countries, adding to the "growth." Without geographic expansion,Herbalife's is in significant decline, but it is now running out of new countries.

- Between the end of 2012, when scrutiny was focused on Herbalife by the Pershing Square fraud thesis presentation, global revenue "grew" by $397.7 million, while China alone grew by $567.7 million. If you take out the China "growth", (increase in China only) during these three years of controversy, Herbalife global revenue, would show a negative 4%. Even with China and other new countries entered, Herbalife still showed global revenue decline in the last two years.

- If globally Herbalife is dependent on China, in the USA, it is clinging to the lifeline of Latino immigrants, a virtually new country it invaded inside the USA to offset information and demographic saturation among the rest of the population. Yet, despite this new base of vulnerable recruits, revenue declined in the USA over the last two years after spiking upon a massive and customized recruiting campaign aimed at low income Latinos and other new immigrants.

Robert FitzPatrick (copyright 2016)